Unlocking Africa's Green Future: Climate Finance & Carbon Credits

Africa

Business

Africa continues to cement its role on the global stage in tackling climate change. Africa is immense in its renewable energy of wind, solar, and hydro power. As the world grapples with high carbon emissions, Africa can significantly influence the transitions of countries to economies of low carbon emissions. However, the efforts that Africa has made in mitigating climate change have not been taken much into consideration. Whereas Africa emits the lowest carbon emissions compared to other continents, it still faces challenges of prolonged droughts, rising ocean levels, and floods.

The Impact of Climate Change on Africa

The Impact of Climate Change on Africa

- 2020–2023, the Horn of Africa was hit by one of the worst droughts in 40 years.

- 2015–2016, Southern Africa region was hit by drought which hit millions across Malawi, Zimbabwe, and Mozambique.

- 1970–1980, the Sahel region that includes Chad, Mali and Niger was greatly hit by drought.

- 2023, the East Africa Region was hit by floods which occurred after the prolonged drought experienced in 2020–2023.

- 2019, the Southern African region was hit by cyclone Dai resulting in devastating floods.

- 2012, West Africa was faced with the worst floods in history that affected millions of people in Chad, Niger and Nigeria.

These are just some of the heavy impacts Africa has experienced in recent times due to climate change. As a result, it has necessitated the African countries to be on the forefront of calling the shots for low carbon emissions.

Africa’s Push for Climate Financing

Africa has called out the need for more investments in climate financing. In 2022, climate financing surged despite the post-effects of COVID-19. Private sector investments in renewable energy, social awareness of climate action, and international support from different climate organizations have been key accelerators for climate financing in Africa. In 2022, the African continent bagged climate finance worth $43.7 billion an upward trajectory from the previous years. In 2022, Africa’s climate financing surpassed the 50 billion USD mark.

Progress and Challenges in Climate Finance

Despite the improvements in Africa's climate financing, more efforts are needed. To meet the 2030 Paris Agreement, it's projected that Africa will have to invest $2.8 trillion to meet the requirements of the reduction in global warming to below 2 degrees Celsius.

Key Climate Targets for Africa by 2030

Other key targets by 2030 are adaptations to drought resistant agriculture, more focus on renewable energy and climate financing and Nationally Determined Contributions (NDCs). To achieve these targets more climate action is not only needed in Africa but also globally.

The Importance of Grassroots Climate Action and Private Sector Involvement

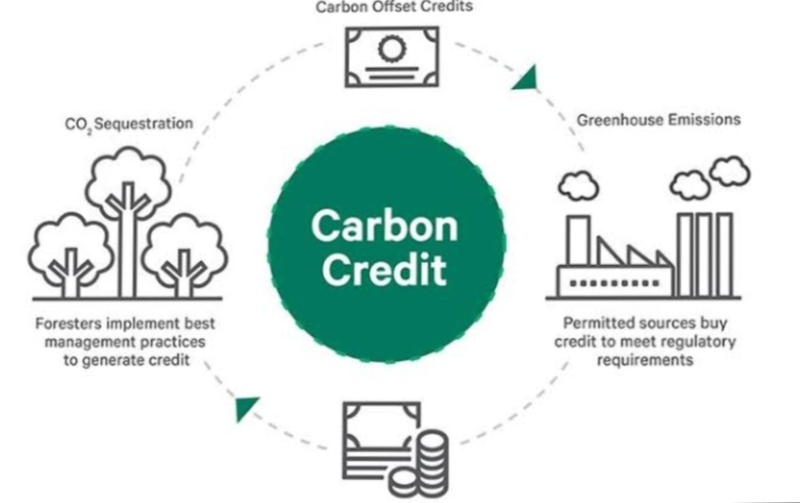

More grassroot climate action is needed and financing small businesses in taking part in climate action. This can be achieved by making international markets accessible by small businesses. Governments need to enhance more carbon credits as a way of reducing carbon emissions by the big manufacturing companies. The private sector is a force that can play a huge role in Africa's climate action due to its strategic prowess in renewable energy making renewable energy cost effective and accessible to all.

The Role of the African Development Bank in Climate Financing

The African Development Bank (ADB) has also been a key contributor in Africa's climate financing. The ADB has established Africa Climate Investment Fund and the Climate Technology Facility.

The Way Forward: Collective Action for a Sustainable Future

Africa's climate financing continues to increase. However, all players are needed on deck. Governments, the international community, private sector, financial institutions and the public will have to work cohesively to achieve low carbon emissions and mitigate further disruptions and disasters due to climate change. Doing so would cut carbon emissions, a realization of sustainable agriculture and growth of African economies.

JANUARY 7, 2025 AT 3:29 PM

Crisis In South Korea: President Yoon Declares Martial Law, Parliament...

Asia

Politics

On December 3rd, 2024, South Korean President Yoon Suk Yeol declared martial law, sparking a new political storm in the country and the region. The decision was attributed to anti-state statements supporting North Korea and growing concerns about the influence of pro-North Korea forces among South Koreans.

Political Tensions Under Yoon Suk Yeol's Leadership

Since his election in 2022 after defeating the Democratic Party’s nominee, Lee Jae Myung, Yoon Suk Yeol's presidency has been marked by heightened political temperatures. He has accused parliament of interfering with government policies, being pro-North Korea, and housing elements he described as “criminals.”

Martial Law: A Shocking Declaration

The declaration of martial law was unexpected, recalling the era before South Korea’s pro-democracy movement against military rule in 1980. Under martial law, all political activities and protests were banned, and the military was given unlimited authority to enforce the decree. Yoon justified his decision in a televised address, stating it was necessary to protect South Korea from anti-state elements.

Immediate Backlash and Swift Parliamentary Action

The imposition of martial law led to protests within parliament, which moved quickly to overturn the president’s decision. Within hours, parliament convened and overwhelmingly voted to lift martial law. This forced President Yoon to withdraw the military from parliament and restore normalcy, although the political turmoil persisted.

Opposition and Calls for Resignation

The opposition, led by Lee Jae Myung, voiced concerns that the declaration of martial law was a crisis for South Korea’s democracy. His sentiments were echoed by parliament, trade unions, and the general public, who expressed discontent with Yoon's leadership. The opposition has since filed a motion to impeach the president, signaling a lack of confidence in his administration.

U.S. and Geopolitical Concerns

The declaration of martial law raised alarm among South Korea’s allies, particularly the United States. With U.S. troops stationed in South Korea as a nuclear deterrent against North Korea, the announcement created concerns about the stability of the region and its potential ripple effects on geopolitics.

A Divided Nation and Changing Political Landscape

The push-and-pull between the legislature and executive branches has left South Korea deeply divided. The political landscape has shifted dramatically, with calls for Yoon’s resignation and increasing criticism of his leadership style and policies.

South Korea's Uncertain Path Forward

President Yoon Suk Yeol’s declaration of martial law, though short-lived, has left an indelible mark on South Korea’s political scene. The world watches closely as the nation navigates this storm, and its citizens await the next steps from their leader. Whether South Korea moves toward stability or deeper political division will shape the country’s future on both domestic and global stages.

Political Tensions Under Yoon Suk Yeol's Leadership

Since his election in 2022 after defeating the Democratic Party’s nominee, Lee Jae Myung, Yoon Suk Yeol's presidency has been marked by heightened political temperatures. He has accused parliament of interfering with government policies, being pro-North Korea, and housing elements he described as “criminals.”

Martial Law: A Shocking Declaration

The declaration of martial law was unexpected, recalling the era before South Korea’s pro-democracy movement against military rule in 1980. Under martial law, all political activities and protests were banned, and the military was given unlimited authority to enforce the decree. Yoon justified his decision in a televised address, stating it was necessary to protect South Korea from anti-state elements.

Immediate Backlash and Swift Parliamentary Action

The imposition of martial law led to protests within parliament, which moved quickly to overturn the president’s decision. Within hours, parliament convened and overwhelmingly voted to lift martial law. This forced President Yoon to withdraw the military from parliament and restore normalcy, although the political turmoil persisted.

Opposition and Calls for Resignation

The opposition, led by Lee Jae Myung, voiced concerns that the declaration of martial law was a crisis for South Korea’s democracy. His sentiments were echoed by parliament, trade unions, and the general public, who expressed discontent with Yoon's leadership. The opposition has since filed a motion to impeach the president, signaling a lack of confidence in his administration.

U.S. and Geopolitical Concerns

The declaration of martial law raised alarm among South Korea’s allies, particularly the United States. With U.S. troops stationed in South Korea as a nuclear deterrent against North Korea, the announcement created concerns about the stability of the region and its potential ripple effects on geopolitics.

A Divided Nation and Changing Political Landscape

The push-and-pull between the legislature and executive branches has left South Korea deeply divided. The political landscape has shifted dramatically, with calls for Yoon’s resignation and increasing criticism of his leadership style and policies.

South Korea's Uncertain Path Forward

President Yoon Suk Yeol’s declaration of martial law, though short-lived, has left an indelible mark on South Korea’s political scene. The world watches closely as the nation navigates this storm, and its citizens await the next steps from their leader. Whether South Korea moves toward stability or deeper political division will shape the country’s future on both domestic and global stages.

DECEMBER 4, 2024 AT 11:23 AM

Donald Trump's Tariff Tactics: The 100% Threat To Brics And...

NorthAmerica

Business

Donald Trump’s recent utterances on the imposition of 100% tariffs on BRICS countries have sparked a new debate in the political and economic sphere on the global scene. This raises questions about the balance of global trade and economic alliances heading into the future.

The Rising Influence of BRICS on the Global Economy

The BRICS nations mainly consist of Brazil, Russia, India, China, and South Africa. The BRICS share a significant portion of the world’s total output. In terms of purchasing power parity, they make up approximately 35% of the global economic output. They also represent an estimated 45% of the world’s population making it the largest bloc in industries and consumer consumption. Such figures highlight the growing influence of the BRICS nations on the global stage.

BRICS and the Push for De-Dollarization

In a move called ‘de-dollarization,’ the BRICS have been developing measures to move away from the use and reliance of the US dollar in the international markets. This aims to create a counter-currency to the US dollar, that would lead to a more balanced global financial system.

Trump’s Warning: 100% Tariffs on BRICS Nations

In a post on social media platforms, Donald Trump stated that any attempts to replace the US dollar in the global financial system by the BRICS nations would be met with rough measures by the US. Nations that replace the US dollar and want to do business with the US will experience a 100% imposition of tariffs. This would mean such nations would cease to do business with the US hampering global economic growth.

Historical Use of Tariffs and Sanctions by the US

The tariffs are economic weapons that the US has previously used as a way of trying to protect its economic status. Some of the countries to have received tariff imposition from the US are Canada, China, and Mexico. During the previous term in office, the most affected nation was China which led to an economic cold war between the two nations.

In Joe Biden’s administration, sanctions have also been imposed on Russia and China which are major economic powerhouse in the BRICS block. Russia has received financial restrictions, export controls of key technologies, asset freezes, and travel bans imposed on influential and government officials. China is also experiencing trade restrictions and human rights sanctions on entities and individuals that abuse human rights by freezing their assets and enhancing travel bans.

Potential Economic Consequences of Imposing Tariffs on BRICS

China and Russia are key players in the global economy. The imposition of 100% tariffs on them and other BRICS nations would lead to a new economic war, which would lead to global economic instability. It would also result in volatility in the trading markets due to uncertainty and the effects of economic policies by the US.

Expert Opinions on the Impact of 100% Tariffs

Economic experts argue that the imposition of 100% tariffs on the BRICS by Donald Trump may not be effective and it could even work against the US, due to the economic complexities brought by the BRICS having a purchasing power parity of an estimated 35% of the global economic output. It is also the second-largest economic bloc after the Regional Comprehensive Economic Partnership (RCEP). This would affect the US population on imports from BRICS, if the nations in the block decide to have a counter-tariff imposition on US goods. The US markets would be faced with increased costs of imported goods.

Domestic Reactions Within the US

Trump’s utterances have however received support from a faction in the US population that argue the US needs to be even more aggressive in protecting the American industries.

The Future of Global Trade and the US Dollar’s Dominance

Trump’s statement on the imposition of 100% tariffs on BRICS countries showcases the ongoing tensions in global, economic, and political relations. It also raises concern about the ability of the US dollar to continue being dominant in the global financial system. The world continues following closely on the impacts of 100% tariffs on BRICS and the global financial system as the BRICS continue looking forward to doing away with the US Dollar.

The Rising Influence of BRICS on the Global Economy

The BRICS nations mainly consist of Brazil, Russia, India, China, and South Africa. The BRICS share a significant portion of the world’s total output. In terms of purchasing power parity, they make up approximately 35% of the global economic output. They also represent an estimated 45% of the world’s population making it the largest bloc in industries and consumer consumption. Such figures highlight the growing influence of the BRICS nations on the global stage.

BRICS and the Push for De-Dollarization

In a move called ‘de-dollarization,’ the BRICS have been developing measures to move away from the use and reliance of the US dollar in the international markets. This aims to create a counter-currency to the US dollar, that would lead to a more balanced global financial system.

Trump’s Warning: 100% Tariffs on BRICS Nations

In a post on social media platforms, Donald Trump stated that any attempts to replace the US dollar in the global financial system by the BRICS nations would be met with rough measures by the US. Nations that replace the US dollar and want to do business with the US will experience a 100% imposition of tariffs. This would mean such nations would cease to do business with the US hampering global economic growth.

Historical Use of Tariffs and Sanctions by the US

The tariffs are economic weapons that the US has previously used as a way of trying to protect its economic status. Some of the countries to have received tariff imposition from the US are Canada, China, and Mexico. During the previous term in office, the most affected nation was China which led to an economic cold war between the two nations.

In Joe Biden’s administration, sanctions have also been imposed on Russia and China which are major economic powerhouse in the BRICS block. Russia has received financial restrictions, export controls of key technologies, asset freezes, and travel bans imposed on influential and government officials. China is also experiencing trade restrictions and human rights sanctions on entities and individuals that abuse human rights by freezing their assets and enhancing travel bans.

Potential Economic Consequences of Imposing Tariffs on BRICS

China and Russia are key players in the global economy. The imposition of 100% tariffs on them and other BRICS nations would lead to a new economic war, which would lead to global economic instability. It would also result in volatility in the trading markets due to uncertainty and the effects of economic policies by the US.

Expert Opinions on the Impact of 100% Tariffs

Economic experts argue that the imposition of 100% tariffs on the BRICS by Donald Trump may not be effective and it could even work against the US, due to the economic complexities brought by the BRICS having a purchasing power parity of an estimated 35% of the global economic output. It is also the second-largest economic bloc after the Regional Comprehensive Economic Partnership (RCEP). This would affect the US population on imports from BRICS, if the nations in the block decide to have a counter-tariff imposition on US goods. The US markets would be faced with increased costs of imported goods.

Domestic Reactions Within the US

Trump’s utterances have however received support from a faction in the US population that argue the US needs to be even more aggressive in protecting the American industries.

The Future of Global Trade and the US Dollar’s Dominance

Trump’s statement on the imposition of 100% tariffs on BRICS countries showcases the ongoing tensions in global, economic, and political relations. It also raises concern about the ability of the US dollar to continue being dominant in the global financial system. The world continues following closely on the impacts of 100% tariffs on BRICS and the global financial system as the BRICS continue looking forward to doing away with the US Dollar.

DECEMBER 2, 2024 AT 11:10 AM

Digital Detox: Why Countries Are Banning Social Media

Asia

Politics

Social media platforms have transformed the way people connect, making the world a global village. Beyond personal connections with friends and family, social media has also become a hub for information dissemination and a key tool for businesses seeking to enhance their online presence and reach wider audiences.

Challenges in Safeguarding Young Users

With increased user engagement, social media platforms have faced criticism for failing to implement adequate safeguards to prevent minors from accessing the platforms. This issue has sparked global debates on the role of social media in protecting vulnerable groups.

Global Restrictions on Social Media Platforms

TikTok has been at the center of bans across several countries since 2022. In Afghanistan, the platform was prohibited to protect young people from potentially misleading information. Similar bans targeting TikTok on government-owned devices have been enacted in Belgium, Canada, Denmark, the European Union, and France. In countries like Syria, Nepal, India, and Iran, TikTok has been banned outright for all users. Most recently, Australia has followed suit with legislation aimed at restricting social media access for young people below the age of 16.

Australia’s Social Media Ban for Minors

On November 28, 2024, Australia imposed a ban on social media use for individuals under 16 years of age. The legislation requires social media companies to introduce mechanisms by the end of 2025 to prevent minors from accessing platforms. Companies that fail to comply could face fines of up to $33 million (50 million Australian Dollars).

Verification Challenges for Social Media Companies

Determining users' ages poses significant challenges for social media platforms, as companies may need to implement verification mechanisms such as video selfies, identification documents, and cross-referencing emails with other platforms. Critics have expressed concerns that these measures might alienate older users who are unfamiliar with advanced technologies.

Opposition from Tech Giants

Tech companies like Meta, Snapchat, and TikTok have voiced opposition to Australia’s legislation, citing rushed policies and lack of consultation. They argue the measures may exclude minorities who rely on social media for support and connection, while burdening parents and teenagers attempting to access these platforms.

Support for the Ban: Protecting Young People

Despite criticism, the ban has gained support from advocates who argue there is a need to protect young users and families from the harmful effects of social media, including mental health issues like anxiety, stress, and depression. Supporters believe social media companies must prioritize the well-being of users over profit motives.

Implications and Lessons for Other Nations

Australia’s legislation sets a precedent for other countries grappling with similar challenges. However, it calls for a balanced approach to regulations, as overly restrictive measures could hinder the benefits realized by businesses and individuals through social media platforms.

Challenges in Safeguarding Young Users

With increased user engagement, social media platforms have faced criticism for failing to implement adequate safeguards to prevent minors from accessing the platforms. This issue has sparked global debates on the role of social media in protecting vulnerable groups.

Global Restrictions on Social Media Platforms

TikTok has been at the center of bans across several countries since 2022. In Afghanistan, the platform was prohibited to protect young people from potentially misleading information. Similar bans targeting TikTok on government-owned devices have been enacted in Belgium, Canada, Denmark, the European Union, and France. In countries like Syria, Nepal, India, and Iran, TikTok has been banned outright for all users. Most recently, Australia has followed suit with legislation aimed at restricting social media access for young people below the age of 16.

Australia’s Social Media Ban for Minors

On November 28, 2024, Australia imposed a ban on social media use for individuals under 16 years of age. The legislation requires social media companies to introduce mechanisms by the end of 2025 to prevent minors from accessing platforms. Companies that fail to comply could face fines of up to $33 million (50 million Australian Dollars).

Verification Challenges for Social Media Companies

Determining users' ages poses significant challenges for social media platforms, as companies may need to implement verification mechanisms such as video selfies, identification documents, and cross-referencing emails with other platforms. Critics have expressed concerns that these measures might alienate older users who are unfamiliar with advanced technologies.

Opposition from Tech Giants

Tech companies like Meta, Snapchat, and TikTok have voiced opposition to Australia’s legislation, citing rushed policies and lack of consultation. They argue the measures may exclude minorities who rely on social media for support and connection, while burdening parents and teenagers attempting to access these platforms.

Support for the Ban: Protecting Young People

Despite criticism, the ban has gained support from advocates who argue there is a need to protect young users and families from the harmful effects of social media, including mental health issues like anxiety, stress, and depression. Supporters believe social media companies must prioritize the well-being of users over profit motives.

Implications and Lessons for Other Nations

Australia’s legislation sets a precedent for other countries grappling with similar challenges. However, it calls for a balanced approach to regulations, as overly restrictive measures could hinder the benefits realized by businesses and individuals through social media platforms.

NOVEMBER 30, 2024 AT 11:48 AM

Starlink's, Africa's Technological Dilemma: A Clash Of Innovation And Regulation

Africa

Technology

Starlink has been facing different challenges in Africa as it seeks entry into the continent’s market. The company aims to revolutionize the Internet space in Africa by making it affordable and convenient to all users. Since its entry into the Kenyan market in July 2023, it has created stiff competition for local Internet providers.

Despite being one of the largest Internet providers in Kenya, companies like Safaricom have been on the receiving end as people seek new Internet services from Starlink. Its competitive pricing has made it possible for users to experience higher Internet speeds compared to local Internet service providers, whose offerings are often slower and more expensive.

Local Providers Push Back Against Competition

The rise of Starlink has raised concerns among local providers. These companies worry they could be pushed out of the market if the government does not take action. The Communication Authority of Kenya (CA) has already sought guidance from the United Nations International Telecommunication Union to develop policies for regulating international satellite Internet providers like Starlink.

For security and regulatory reasons, Safaricom has proposed that Starlink should consider partnering with local Internet service providers. Legal battles have ensued as local providers attempt to prevent Starlink from gaining a dominant market share in Kenya.

Regulatory Hurdles in Namibia

The challenges are not limited to Kenya. In Namibia, Starlink has encountered significant regulatory resistance. The Communications Regulatory Authority of Namibia (CRAN) issued a cease-and-desist order against the company, citing its lack of a government-issued operating license.

Namibia, known for its vast rural areas with limited Internet infrastructure, saw Starlink as a potential game-changer. The company's high-speed Internet service appealed to both urban and rural users alike. However, CRAN has not only stopped operations but has also confiscated Starlink equipment from consumers and initiated legal proceedings against individuals using the service.

Until Starlink secures a proper license from the Namibian government, it is barred from resuming operations in the country.

A Continent Still Struggling with Internet Access

Africa continues to experience low Internet penetration. Only a few countries—such as Morocco, Libya, and Seychelles—report relatively high Internet penetration, with average rates around 80%. In contrast, the rest of the continent struggles with affordability and accessibility of Internet services.

As the continent grows and digital demand rises, the need for reliable Internet access becomes increasingly urgent. However, local Internet providers across Africa often fall short, particularly in delivering consistent broadband services to both urban and rural communities.

The Road Ahead for Starlink and African Connectivity

Companies like Starlink see an opportunity to bridge Africa’s digital divide. However, the regulatory challenges faced in Kenya and Namibia underline the need for innovative tech companies to fully comply with local laws and licensing frameworks when expanding into the African market.

At the same time, local Internet service providers must also rise to the occasion by improving service quality and affordability to remain competitive in the changing landscape.

Despite being one of the largest Internet providers in Kenya, companies like Safaricom have been on the receiving end as people seek new Internet services from Starlink. Its competitive pricing has made it possible for users to experience higher Internet speeds compared to local Internet service providers, whose offerings are often slower and more expensive.

Local Providers Push Back Against Competition

The rise of Starlink has raised concerns among local providers. These companies worry they could be pushed out of the market if the government does not take action. The Communication Authority of Kenya (CA) has already sought guidance from the United Nations International Telecommunication Union to develop policies for regulating international satellite Internet providers like Starlink.

For security and regulatory reasons, Safaricom has proposed that Starlink should consider partnering with local Internet service providers. Legal battles have ensued as local providers attempt to prevent Starlink from gaining a dominant market share in Kenya.

Regulatory Hurdles in Namibia

The challenges are not limited to Kenya. In Namibia, Starlink has encountered significant regulatory resistance. The Communications Regulatory Authority of Namibia (CRAN) issued a cease-and-desist order against the company, citing its lack of a government-issued operating license.

Namibia, known for its vast rural areas with limited Internet infrastructure, saw Starlink as a potential game-changer. The company's high-speed Internet service appealed to both urban and rural users alike. However, CRAN has not only stopped operations but has also confiscated Starlink equipment from consumers and initiated legal proceedings against individuals using the service.

Until Starlink secures a proper license from the Namibian government, it is barred from resuming operations in the country.

A Continent Still Struggling with Internet Access

Africa continues to experience low Internet penetration. Only a few countries—such as Morocco, Libya, and Seychelles—report relatively high Internet penetration, with average rates around 80%. In contrast, the rest of the continent struggles with affordability and accessibility of Internet services.

As the continent grows and digital demand rises, the need for reliable Internet access becomes increasingly urgent. However, local Internet providers across Africa often fall short, particularly in delivering consistent broadband services to both urban and rural communities.

The Road Ahead for Starlink and African Connectivity

Companies like Starlink see an opportunity to bridge Africa’s digital divide. However, the regulatory challenges faced in Kenya and Namibia underline the need for innovative tech companies to fully comply with local laws and licensing frameworks when expanding into the African market.

At the same time, local Internet service providers must also rise to the occasion by improving service quality and affordability to remain competitive in the changing landscape.

NOVEMBER 28, 2024 AT 10:41 PM

Nissan's Global Overhaul: Restructuring Amidst The Chinese Ev Revolution

Asia

Business

The automobile landscape globally is changing dynamically. With new players emerging while others slump due to various factors, such as competition from other auto players. This has led several auto companies to rethink their strategies in the industry, as a way of smoothing operations and increasing their sales.

China’s Dominance in Global Auto Sales

The Asian auto industry continues to dominate the global auto sales, with China being the biggest contributor to the global auto sales. As of March 2024, Chinese car auto sales accounted for 33% of the world’s car sales. The significant market share highlights the growing influence of China in the auto industry in times of electric vehicles (EVs) and new energy vehicles (NEVs).

NISSAN’s Struggles Amid Rising Chinese Competition

This has affected other automakers in the Asian region. Japanese automaker, NISSAN has had to go back to the drawing board to restructure its operations in Thailand. NISSAN has enjoyed a significant market share in the region for a long time. The automaker is expected to cut 9000 jobs globally. The rise of Chinese auto giants like BYD has been a pain to NISSAN as the company faces stiff competition due to the influx of Chinese EVs in Thailand.

Impact of Chinese EVs on the Asian Auto Market

NISSAN's challenges are attributed to the technological advancements in the Chinese automakers and their affordability capturing a significant market share in Asia and the global arena. These unprecedented factors have forced NISSAN to announce restructuring by streamlining its operations and cutting down on costs. The company is expecting to put on hold and consolidate some of its operations in Thailand and other regions.

NISSAN’s Restructuring Strategy in Thailand

The company’s financial performance has been affected by market trends such as increased use of electric vehicles and post-COVID-19 pandemic effects. The company also faces a decline in sales which has negatively impacted its financial performance. The company reported a decline in sales by 33% in the year ended 2023. By consolidating its operations and cutting down on jobs, NISSAN expects to increase its efficiency and improve its financial performance. The company has insisted that it's not looking forward to shutting down its operations in Thailand, but rather adapting to the new dynamics in the auto industry market.

Thailand’s Favorable Policies for Chinese EV Automakers

The rise of EVs in Thailand has not only been due to heavy investment by the Chinese government through the provision of subsidies in promoting EVs automakers such as BYD and SAIC, but also Thailand’s government has a soft spot for the Chinese EVs by enacting policies that enable them to thrive. This has made the Chinese EVs cheaper and more appealing to consumers as compared to other competitor brands from other countries.

Shifting Market Share in Thailand and Beyond

The popularity of Chinese EVs has diminished the Japanese market share in Thailand as well as in the global space. The restructuring efforts in cutting down costs by NISSAN in Thailand highlight the changing dynamics in the auto space due to the increased usage of Chinese cars by consumers.

Lessons for the Future of the Global Auto Industry

It also puts on notice other auto players in the industry to rethink their approach in the auto market. For NISSAN and other car companies in Thailand and other regions, to avoid disruption and experience success, they will have to be more innovative and adapt to the current times, failure to which they shall be wiped out of the indust

China’s Dominance in Global Auto Sales

The Asian auto industry continues to dominate the global auto sales, with China being the biggest contributor to the global auto sales. As of March 2024, Chinese car auto sales accounted for 33% of the world’s car sales. The significant market share highlights the growing influence of China in the auto industry in times of electric vehicles (EVs) and new energy vehicles (NEVs).

NISSAN’s Struggles Amid Rising Chinese Competition

This has affected other automakers in the Asian region. Japanese automaker, NISSAN has had to go back to the drawing board to restructure its operations in Thailand. NISSAN has enjoyed a significant market share in the region for a long time. The automaker is expected to cut 9000 jobs globally. The rise of Chinese auto giants like BYD has been a pain to NISSAN as the company faces stiff competition due to the influx of Chinese EVs in Thailand.

Impact of Chinese EVs on the Asian Auto Market

NISSAN's challenges are attributed to the technological advancements in the Chinese automakers and their affordability capturing a significant market share in Asia and the global arena. These unprecedented factors have forced NISSAN to announce restructuring by streamlining its operations and cutting down on costs. The company is expecting to put on hold and consolidate some of its operations in Thailand and other regions.

NISSAN’s Restructuring Strategy in Thailand

The company’s financial performance has been affected by market trends such as increased use of electric vehicles and post-COVID-19 pandemic effects. The company also faces a decline in sales which has negatively impacted its financial performance. The company reported a decline in sales by 33% in the year ended 2023. By consolidating its operations and cutting down on jobs, NISSAN expects to increase its efficiency and improve its financial performance. The company has insisted that it's not looking forward to shutting down its operations in Thailand, but rather adapting to the new dynamics in the auto industry market.

Thailand’s Favorable Policies for Chinese EV Automakers

The rise of EVs in Thailand has not only been due to heavy investment by the Chinese government through the provision of subsidies in promoting EVs automakers such as BYD and SAIC, but also Thailand’s government has a soft spot for the Chinese EVs by enacting policies that enable them to thrive. This has made the Chinese EVs cheaper and more appealing to consumers as compared to other competitor brands from other countries.

Shifting Market Share in Thailand and Beyond

The popularity of Chinese EVs has diminished the Japanese market share in Thailand as well as in the global space. The restructuring efforts in cutting down costs by NISSAN in Thailand highlight the changing dynamics in the auto space due to the increased usage of Chinese cars by consumers.

Lessons for the Future of the Global Auto Industry

It also puts on notice other auto players in the industry to rethink their approach in the auto market. For NISSAN and other car companies in Thailand and other regions, to avoid disruption and experience success, they will have to be more innovative and adapt to the current times, failure to which they shall be wiped out of the indust

NOVEMBER 27, 2024 AT 2:30 PM