Africa 2026 Investment And Risk Outlook: How The Drc–Rwanda Peace Deal And Kenya–Us Health Pact Define The Execution Challenge

Executive Summary

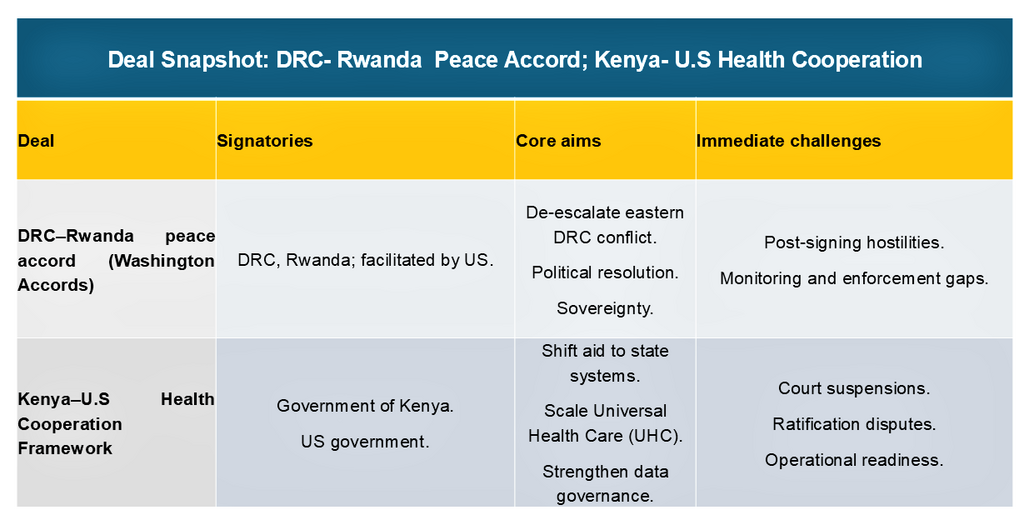

Africa’s 2026 growth and risk landscape is being reshaped by high-stakes agreements and regional macro developments. The Washington Accords between the DRC and Rwanda aim to de-escalate conflict in eastern Congo, while Kenya’s Health Cooperation Framework with the US seeks to strengthen state-led healthcare financing.

Investment, trade, and insurance outcomes in Africa in 2026 will depend more on implementation, governance, and enforcement than on policy announcements.

The DRC–Rwanda peace deal, commonly referred to as the Washington Accords, is a US-facilitated agreement signed in 2025 to reduce hostilities in eastern Democratic Republic of the Congo. The accord emphasizes sovereignty, non-interference, ceasefire adherence, and political dialogue, with the stated goal of enabling regional trade, investment, and humanitarian access.

The United Nations views the agreement as a “critical step,” while cautioning that hostilities persist near border areas, underscoring the fragility of implementation (UN, 2025).

.png)

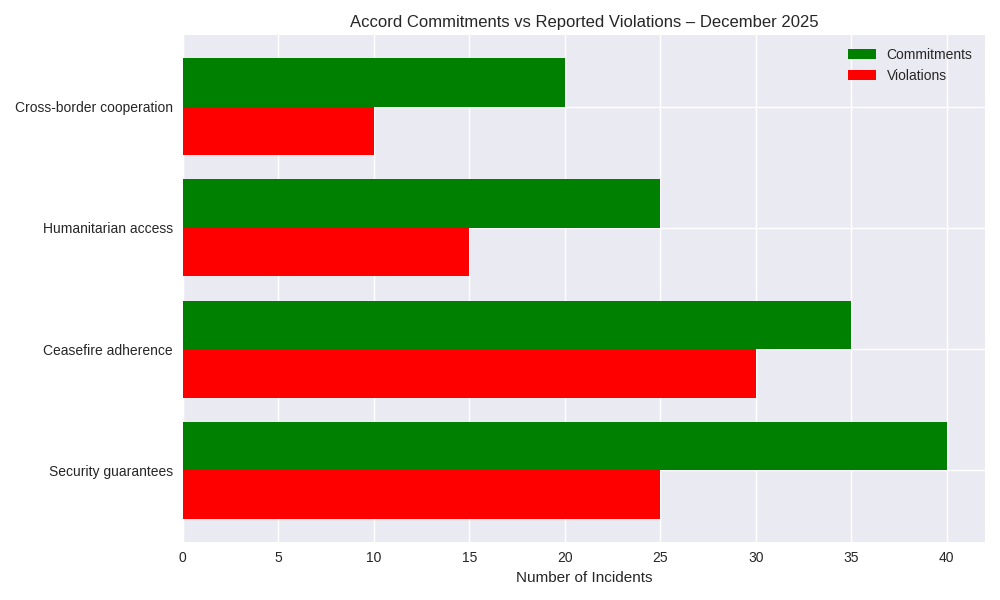

Key insight: The visual shows that while commitments under the Washington Accords were substantial whereby violations remained high, especially in ceasefire adherence, highlighting fragile enforcement. Conflict nodes in North Kivu overlap with humanitarian corridors, meaning instability directly threatens aid delivery and regional trade.

Major Insights from the Graph

- Security guarantees vs. violations: Commitments (40) outpaced violations (25), suggesting partial compliance. Yet the gap is narrower than expected, showing enforcement challenges.

- Ceasefire adherence: Violations (30) nearly matched commitments (35), indicating the ceasefire is the weakest pillar of the accord. This undermines confidence in DDR (disarmament, demobilization, reintegration) programs.

- Humanitarian access: Commitments (25) were higher than violations (15), showing relatively better compliance. Still, violations here directly impact aid delivery to civilians.

- Cross-border cooperation: Lowest commitments (20) and violations (10), reflecting limited progress but also fewer flashpoints compared to internal ceasefire issues.

- Fragile peace: High violation rates in ceasefire adherence suggest relapse risk. Without stronger monitoring, the accord may fail to stabilize eastern DRC.

- Humanitarian risk: Aid corridors intersect with conflict zones, raising insurance premiums and deterring NGOs from scaling operations.

- Business impact: Mineral supply chains (cobalt, 3T minerals) remain vulnerable to disruption. Firms will need conflict-sensitive sourcing and diversified logistics.

- Policy challenge: Enforcement gaps demand third-party monitoring (UN, AU) and incentives for compliance. Without this, commerce-led engagement will stall.

%20(2).png)

- Overall Growth: Total U.S. health allocations to Kenya steadily increase year by year from 2026 to 2031.

-

Consistent Expansion: Each category (HIV Services, Laboratory Systems, Treatment Commodities) shows upward growth, indicating sustained investment.

- HIV Services (Blue): Largest share of funding across all years, reflecting continued prioritization of HIV response.

- Laboratory Systems (Orange): Moderate but steady growth, highlighting emphasis on strengthening diagnostic infrastructure.

-

Treatment Commodities (Green): Noticeable increase over time, suggesting scaling up of essential medicines and supplies.

- Shift Toward Systems Strengthening: The rising allocations for lab systems and commodities show a pivot from aid dependency toward building Kenya’s health system capacity.

- Universal Health Coverage (UHC) Support: The funding aligns with Kenya’s UHC goals, ensuring broader access to treatment and diagnostics.

-

Partnership Stability: The consistent upward trend signals long-term U.S. commitment to Kenya’s health sector.

- Fragility risk: Continued hostilities and violation claims could trigger localized escalation and erode confidence in DDR and monitoring mechanisms.

- Enforcement gap: Non-signatory militias, contested control zones, and limited verification capacity elevate relapse risk without credible third-party oversight.

- Political volatility: Commerce-first messaging is constructive but vulnerable to security reversals, electoral pressures, and cross-border tensions.

- Legal and governance risk: Court suspensions cloud timelines for data transfers, procurement, and disbursements, affecting vendors and implementers.

- Data protection risk: Despite statutory assurances, cross-border data use remains a reputational and compliance exposure without DPIAs, localization options, and regulator clarity.

- Operational risk: Redirecting funds to state systems requires strong fiscal controls, supply-chain integrity, and performance monitoring, especially for high-visibility HIV programs.

- Fiscal Reforms: Removal of fuel subsidies, exchange-rate unification, and higher revenue collection.

- Risks: Inflation, FX volatility, and social resistance.

- Energy Crisis: Load shedding persists, private generation grows, but transmission bottlenecks remain.

- Trends: Infrastructure-led growth continues in Ethiopia and Tanzania but is debt-sensitive.

-

Egypt and Morocco: Relative political stability but exposed to external financing pressures and climate stress.

%20(1).jpg)

1 = Low risk / high execution capacity

5 = High risk / fragile execution

- Great Lakes minerals: Sustained peace could stabilize cobalt and 3T mineral logistics; renewed violence would raise insurance premiums, security surcharges, and route-diversion costs.

- Compliance exposure: Firms operating in eastern DRC face elevated due-diligence requirements tied to conflict-sensitive sourcing and beneficiary vetting.

- Market restructuring: Kenya’s shift to state-led financing reshapes supplier relationships and may reduce NGO-led channels, affecting payment cycles and audit regimes.

- Data services: Health-tech and informatics providers must align with national data laws; cross-border analytics will require enhanced contractual and regulatory safeguards.

- Risk pricing: Underwriters will track DDR progress, border incidents, and court rulings in real time, directly influencing premiums for logistics, health procurement, and PPPs.

2026 is a decisive year for Africa’s risk and investment trajectory. If governments can translate peace accords, fiscal reforms, health financing shifts, and energy policies into credible enforcement and delivery, the payoff will be lower risk premiums, more stable supply chains, and longer-term capital commitment.

If execution falters,through renewed conflict in eastern DRC, prolonged legal uncertainty in Kenya, reform fatigue in Nigeria, or persistent energy failures in South Africa, the result will be higher insurance costs, delayed investment, and a reversion to short-term, risk-averse capital.

The outcome will be determined not by ambition or diplomacy, but by follow-through at courts, checkpoints, grids, and public institutions.

1. Execution risk dominates the investment case

Peace accords (DRC–Rwanda), health financing reforms (Kenya), fiscal adjustments (Nigeria), and energy reforms (South Africa) are all directionally positive. However, weak enforcement, court interventions, infrastructure bottlenecks, and political pushback create volatility across sectors.

2. Risk is uneven and increasingly priced in real time

Eastern DRC and South Africa remain high-risk operating environments due to security and energy constraints. Kenya and Nigeria present medium-high risk, where reforms are credible but legally and politically exposed. North Africa offers lower security risk but higher macro and external financing sensitivity.

3. Supply chains and cash flow are the primary pressure points

Minerals (cobalt, 3T) face disruption from insecurity and insurance repricing. Health procurement and digital services face delays, compliance costs, and data governance exposure. Energy unreliability and FX volatility directly affect margins, timelines, and financing costs.

4. Resilience is now a competitive advantage

Investors with diversified logistics, flexible contracts, localized data strategies, and strong compliance systems will outperform. Passive exposure to “Africa growth” narratives without mitigation will underperform.

What Policymakers Need to Know

1. Agreements without enforcement erode trust

The DRC–Rwanda accord risks losing credibility without independent monitoring and consequences for violations.

Kenya’s health reform agenda faces reputational risk if legal and data governance issues are not resolved transparently.

2. Legal clarity is now a macro-stability issue

Court suspensions, regulatory ambiguity, and opaque ratification processes delay investment and raise sovereign risk premiums.

Predictable legal pathways are as important as fiscal or security reforms.

3. State capacity is the binding constraint

Shifting financing to government systems (Kenya, Nigeria) increases ownership but also exposes weaknesses in procurement, fiscal controls, and service delivery.

Energy and infrastructure failures (South Africa) impose economy-wide costs.

4. Investor confidence is conditional

Markets reward reform intent only when paired with verifiable implementation milestones.

Poor execution now results in higher insurance premiums, delayed financing, and reduced policy space later.

- Execution over agreements: Implementation determines real outcomes.

- Embed resilience: Conflict-sensitive sourcing, flexible contracts, and contingency planning are essential.

- Monitor real-time indicators: Security incidents, court rulings, FX, and energy metrics.

- Calibrate regionally: Nigeria (fiscal), South Africa (energy), East Africa (procurement), North Africa (macro).

-

Opportunity is conditional: Governance, institutional capacity, and enforcement drive returns.

Frequently Asked Questions (FAQs)

1: What is the DRC–Rwanda peace deal’s significance for 2026?

Reduces eastern DRC conflict, but fragile enforcement maintains high DDR and supply-chain risk.

Procurement channels shift; compliance burdens increase; timelines are uncertain.

Ceasefire compliance, DDR progress, court rulings, FX, energy reliability, and regulatory clarity.

DRC/Rwanda and South Africa (risk score 5), followed by Kenya and Nigeria (risk score 4).