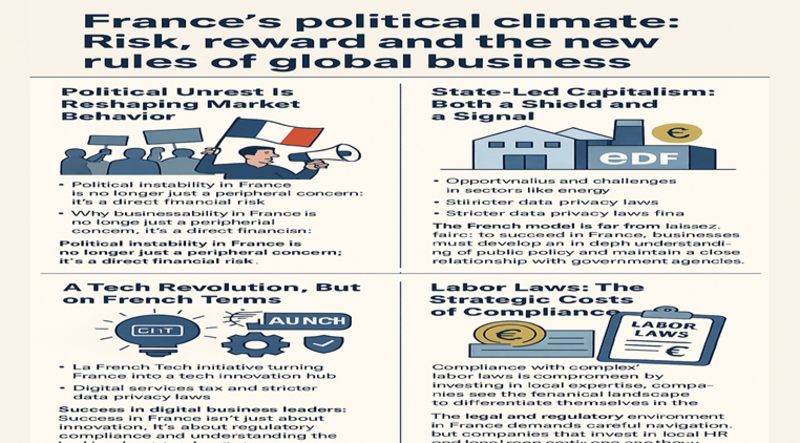

An image showing with writings indicating France's political climate, risk, rewards and rules of doing business. Image Credits: AI generated

An image showing with writings indicating France's political climate, risk, rewards and rules of doing business. Image Credits: AI generated

France's Political Climate: Risk, Reward And The New Rules Of Global Business.

Protests in 2023: A Wake-Up Call for Businesses

In 2023, France experienced massive protests sparked by President Emmanuel Macron’s pension reform plans. Over a million people took to the streets, causing public transport to grind to a halt, disrupting supply chains, and altering consumer behaviors almost overnight.

Retail giants like Carrefour and hospitality leaders such as Accor Hotels faced severe operational disruptions, with tourism revenue in Paris dropping by an estimated 30% during peak protest weeks. The unrest also led to a temporary contraction in consumer spending and reduced business investment in sectors like retail and hospitality, according to the Paris Tourism Board.

Political instability in France has evolved from being a peripheral concern to a direct financial risk for businesses operating in the country.

State-Influenced Capitalism: Opportunities and Challenges

A defining characteristic of France’s economy is its state-influenced capitalism. In 2023, the government fully renationalized EDF, one of Europe’s largest energy utilities. This move stabilized the energy sector but reinforced the notion that private enterprises must yield when national interests are at stake.

For companies in industries such as aerospace, defense, and energy—including Airbus, Thales, and Alstom—this model presents both opportunities and challenges. The French state frequently provides financial backing and regulatory clarity, but businesses must align with government priorities. Foreign companies operating in France must be ready to adapt to these regulations and collaborate with local players to navigate state-driven requirements effectively.

La French Tech: Transforming France into a Tech Hub

In recent years, the La French Tech initiative has turned France into a major hub for tech innovation, with Paris emerging as a strong competitor to cities like London and Berlin for fintech and AI startups. Today, France boasts over 30 tech unicorns, fueled by:

- Tax incentives

- Public-private partnerships

- Targeted funding

However, France has also asserted its regulatory power over global tech giants. The introduction of the Digital Services Tax (DST), a 3% levy on revenues from large digital firms, specifically targeted U.S. companies like Google and Amazon. This policy challenges non-European players entering the French market while favoring local firms.

Additionally, France’s strict data privacy laws—often exceeding the EU baseline—require businesses to adapt their operations to meet heightened standards.

Labor Protections: Turning Challenges into Advantages

France is renowned for its robust employee protections. While the Macron ordinances of 2017 streamlined parts of labor law, compliance remains complex and costly. A 2022 survey by the American Chamber of Commerce in France found that 42% of U.S. firms consider labor rigidity their greatest operational challenge. However, the same survey revealed growing satisfaction with France’s tax reforms and vibrant tech sector.

Global firms like Amazon have turned labor challenges into competitive advantages by investing in local expertise. By assembling strong legal teams and collaborating with labor unions, companies have successfully navigated complex regulations, transforming compliance into operational efficiency and market differentiation.

Unlocking France’s Advantages: A Strategic Approach

For global business leaders, France provides unparalleled access to:

- The European Union market

- A highly skilled workforce

- A thriving innovation ecosystem

Conclusion: Navigating Complexity for Strategic Edge

While France’s political and regulatory environment poses challenges, it also offers unique opportunities for businesses willing to embrace its complexity. For those ready to engage with its legislation, partner with local players, and adapt to shifting dynamics, France delivers not only hurdles but a strategic edge in the European market.