Africa in motion: powering progress from the continent to global trade routes. Photo Credits: Grace Waithera

Africa in motion: powering progress from the continent to global trade routes. Photo Credits: Grace Waithera

Why Africa Trades With The World But Not Itself: The $5 Billion Cost Of Fragmentation

Africa has the resources, demand, and demographic heft to thrive. What’s missing? The collective muscle memory to harness them.

- Trade → Ethiopia imports steel from China cheaper than from South Africa (Afreximbank 2023).

- Healthcare → Africa spends $2B/year training doctors who then staff European hospitals, while 1 in 3 clinics on the continent has no physician (WHO).

- Travel → Only 4 African nations offer visa-free entry to all Africans. For comparison, Americans visit 13–30 African countries visa-free.

- Infrastructure → Zambia’s copper exports still route through Dar es Salaam, not Namibia’s closer ports.

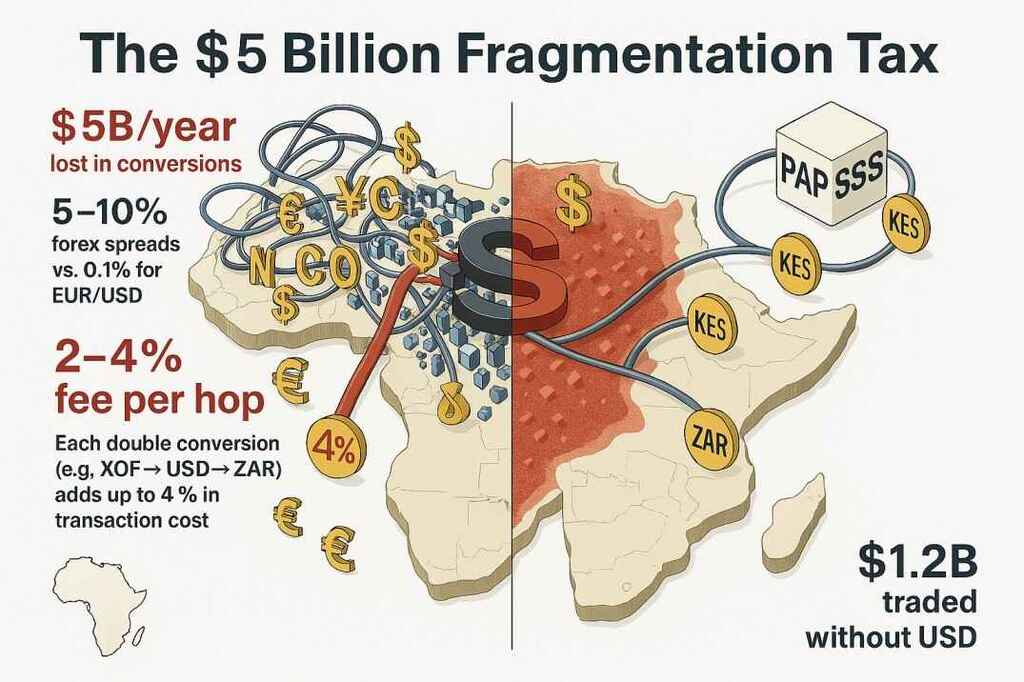

- Digital → Internet traffic between Lagos and Accra (450km) detours 7,000km through Europe (Afrinic). Forex → $5 billion/year is lost by 42 African nations in currency conversions (Afdb).

Most African currencies trade in thin markets, with bid-ask spreads 5-10x wider than EUR/USD.

2. Dollar Dependency = Free Money for Intermediaries

Intra-African trade often requires double conversions (e.g., XOF → USD → ZAR), adding 2-4% fees per transaction.

Parallel Markets: In Nigeria, the naira’s black-market rate trades 40% below official rates (IMF 2023).

3. Central Banks on Life Support

Low Reserves: 60% of African central banks hold <3 months of import cover, leaving currencies vulnerable to speculative attacks.

4. No Hedging = Investor Flight

Only South Africa, Egypt, Kenya have liquid currency futures. Others face 8-12% hedging costs (vs. 1-3% in developed markets).

Colonial Logistics, Modern Consequences

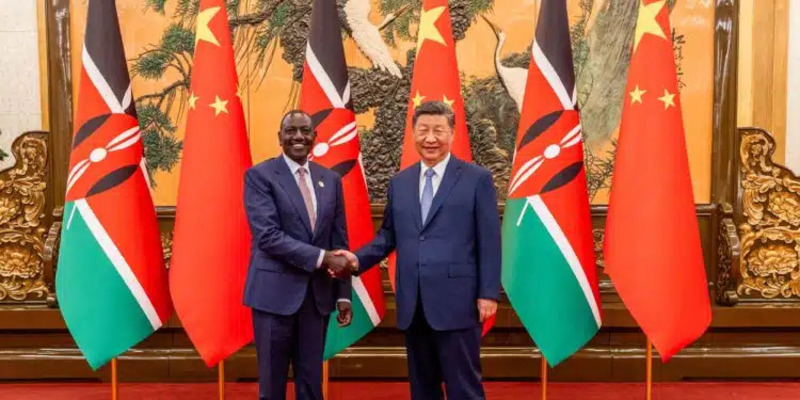

- Ports: 73-78% of port capacity is foreign-controlled (China owns 19-23%).

- Trucking: A Mombasa-Kampala haul spends 18 hours at borders, longer than the actual drive (TMEA).

- Airlines: African carriers fill 62% of seats on continental routes vs. 82% on Europe-Africa flights (IATA).

- Informal Trade: 38-42% of intra-African commerce happens off the books (UNCTAD).

The ultimate irony? When COVID hit, Africa created a mutual health passport system in 9 weeks.

Proof: Integration is possible when lives depend on it.

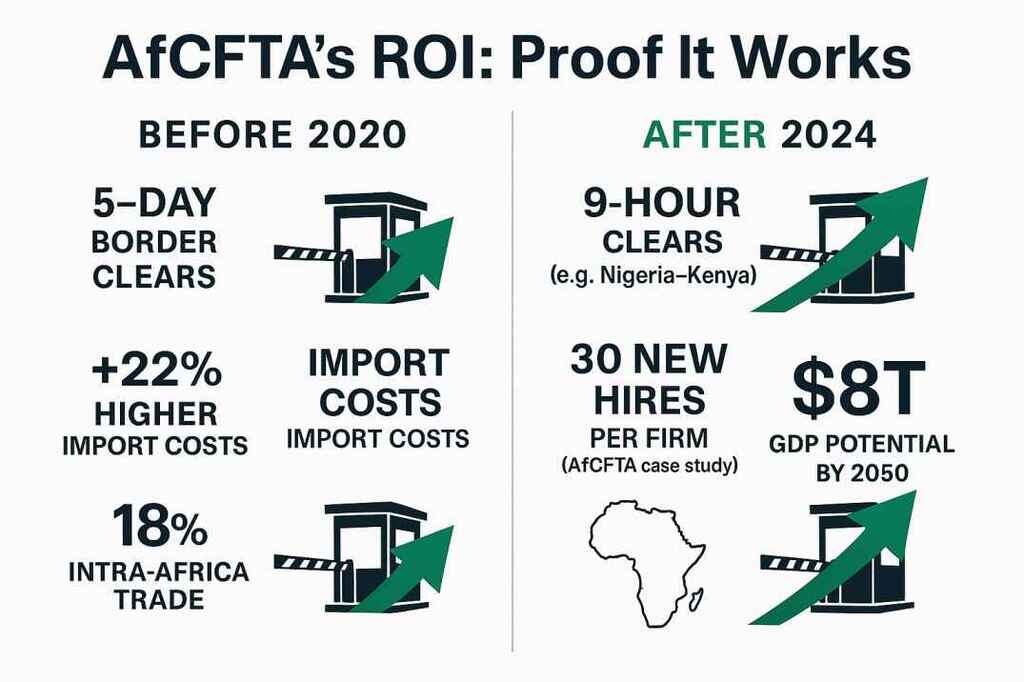

- Nigerian firms slashed parts imports from Kenya by 22%.

- Border clearance times fell from 5 days to 9 hours in pilot corridors (AfCFTA Q2 2024).

2. Fintech’s Forex Rebellion

- PAPSS: Cleared $1.2B in trade without touching the dollar.

- Chipper Cash: Handles 500,000 cross-border SMB transactions/month.

- Wave: Cuts XOF-zone remittance costs by 75%.

3. Infrastructure Mutiny

- Lori Systems: Uses AI to cut border delays in 11 countries.

- Africa Data Centres: Locally routes 38% of intra-African internet traffic.

Who Must Act?

- Ratify AfCFTA Phase II (47/54 nations are stalled).

- Roll out the African Passport by 2025.

- Deploy armed trade corridor escorts (not just peacekeepers).

Businesses:

- Dangote Cement added $1.3B revenue by prioritizing regional expansion.

- MTN’s $1B fiber network cut West African data costs by 60%.

Citizens:

- Demand visa openness (Rwanda’s policy created 150,000 jobs).

- FixTheCountry movements (like Ghana’s) forced port reforms.

Bottom Line: The Clock is Ticking

Kwame Nkrumah warned in 1963: "Unite or perish." Today, it’s unite or stagnate. The tools exist. The models work. The only question: Will leaders lead, or will they be outpaced by the entrepreneurs and engineers already building the future?

Final Answer: Africa’s economic fragmentation isn’t fate, it’s a series of solvable problems. The first step is admitting the receipt it has been handed is too damn high.