CMC's New Holland TT4.90 in the Kenya's Agriculture space. Photo Credits: CMC

CMC's New Holland TT4.90 in the Kenya's Agriculture space. Photo Credits: CMC

Cmc Motors Group Bids Farewell To East Africa: A Legacy Of Over 40 Years Ends In Kenya, Uganda, And Tanzania

Leadership in Agricultural Solutions

CMC Motors Group has been a leader in providing agricultural solutions in Kenya, offering products such as Field King, Nandi farm implements, Hero Motorbikes, and New Holland Tractors. This has made CMC Motors Group the largest distribution supplier of automobiles in the East Africa Region.

CMC Motors’ Operations Across East Africa

The company has had 7 branches and 6 divisions in Kenya, along with sister companies in Uganda and Tanzania. However, as of 17th January 2025, the company announced its decision to cease operations in Kenya, Uganda, and Tanzania, citing the declining economic environment in the region.

Restructuring Efforts and Economic Pressure

In 2023, the company underwent restructuring to smoothen its business operations and increase profits, but economic pressure prompted the decision to exit the region.

Impact on Farmers and Livelihoods

CMC Motors Group’s closure will affect a large pool of farmers who rely on its mechanization solutions for agricultural purposes, as well as result in job losses for people across Kenya, Uganda, and Tanzania.

Support During Transition

The company has pledged to maintain a smooth transition by supporting employees through the transition period and adhering to legal processes in Kenya, Uganda, and Tanzania.

Challenges for Businesses in East Africa

CMC Motors Group’s exit highlights the continuing challenges experienced by businesses in the East African Region as they fail to meet their goals of service delivery and increased earnings.

Other Companies that have exited Kenya

Several companies have ceased operations in Kenya, including:

- De La Rue (2023): Due to a decline in money-printing contracts from the Central Bank of Kenya (CBK).

- Africa Oil (2023): Exited the Turkana oil project.

- Builders (2023): Exited due to increased losses.

- Nestle (2023): Ceased operations citing challenges.

- Neumann Kaffee Gruppe (NKG) Mills Kenya (2024): Exited due to changes in coffee sector regulatory policies.

- Game Stores (2022): Closed down due to financial losses and failure to find a buyer.

Banking Sector Challenges in Uganda

The banking sector in Uganda has also suffered, with closures including Greenland Bank, Teefe Bank, International Credit Bank, Cooperative Bank, National Bank of Commerce, Global Trust Bank, Crane Bank Limited, and EFC Uganda Limited.

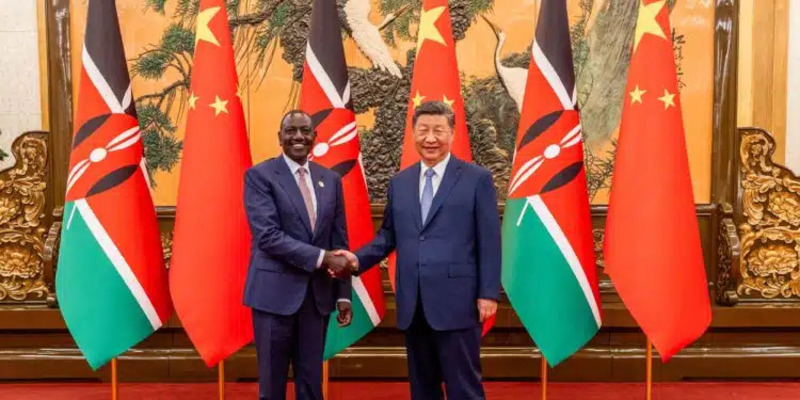

Need for Government Intervention

The continued closure of major corporations in East Africa points to a poor business environment caused by regulatory hurdles, corruption, competition from local brands, high operational costs, and increased taxation. Governments in the region must focus on win-win policies to safeguard livelihoods, promote investors, and increase GDP in East Africa.