JPMorgan Chase corporate sign in New York. Photo Credits: Dreamstime

JPMorgan Chase corporate sign in New York. Photo Credits: Dreamstime

Jp Morgan Chase Expands Into Kenya: A New Era For East African Finance

A Vision 12 Years in the Making

JP Morgan Chase, one of the world’s largest and most influential banks, first expressed its interest in establishing a presence in Kenya back in 2012. Now, with the approval of the Central Bank of Kenya (CBK), the bank has officially launched operations in Nairobi, setting the stage for an expanded footprint across Africa’s emerging markets.

The decision to establish a base in Kenya aligns with JP Morgan’s broader strategy of tapping into emerging markets and promoting cross-border trade. By anchoring itself in Kenya, the bank is poised to access a wider client base across East Africa, a region increasingly recognized for its dynamic economic growth.

Strategic Leadership: Sailepu Montet at the Helm

To spearhead its operations in Kenya, JP Morgan has appointed Sailepu Montet as the head of the Nairobi office. Montet, a former Deputy Director of Financial Markets and Head of Reserves Management at the CBK, brings a wealth of experience to the role. His prior roles at Barclays Plc and Absa Group Ltd position him perfectly to lead JP Morgan’s growth in a competitive financial landscape.

Montet’s appointment is a strategic move designed to leverage his deep understanding of Kenya’s financial ecosystem, regulatory environment, and market dynamics — all crucial elements for the success of JP Morgan’s ambitious regional plans.

Catalyzing Trade, Investment, and Economic Growth

JP Morgan’s new office will serve as a catalyst for trade, investment, and economic development, not only in Kenya but across the entire East African region. By offering a wide array of financial services, including corporate banking, investment advisory, and cross-border trade financing, JP Morgan aims to support local businesses, attract foreign investments, and foster greater economic integration within the region.

The Nairobi office will become a pivotal platform for businesses seeking seamless financial solutions as Kenya continues to position itself as the gateway to East Africa.

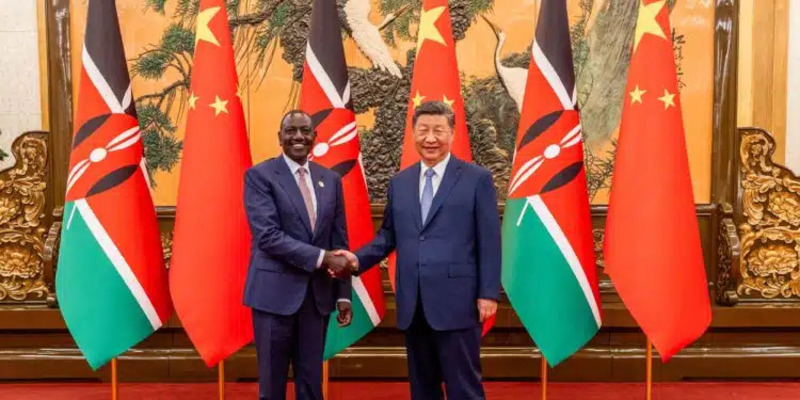

Jamie Dimon's Africa Tour: Strengthening Commitments

Adding weight to the bank’s commitment to Africa, JP Morgan CEO Jamie Dimon visited Kenya as part of a four-nation tour aimed at strengthening the bank’s ties across the continent. Dimon's visit underscores the strategic importance JP Morgan places on Africa’s growth markets and reaffirms the bank’s long-term commitment to supporting development on the continent.

Implications for Kenya’s Financial Sector

JP Morgan’s entry is set to usher in a new era for Kenya’s financial landscape. As global competition intensifies, local banks and financial institutions are expected to enhance their products, services, and customer experiences to remain competitive. The banking sector, alongside the rapidly expanding SACCO (Savings and Credit Cooperative) movement in Kenya, has seen remarkable growth, and JP Morgan’s presence will only serve to amplify this momentum.

Moreover, JP Morgan’s investment signifies growing international confidence in Kenya's regulatory environment, economic stability, and its position as a regional leader.

A New Chapter for East Africa

With a population hungry for innovation, a rapidly digitalizing economy, and strategic access to broader African markets, Kenya presents enormous opportunities for financial institutions. JP Morgan’s establishment in Nairobi is not just an expansion — it’s a statement about the future of East Africa as a key player in the global financial ecosystem.

As JP Morgan continues to strengthen its operations across the continent, the financial landscape in Kenya and East Africa is set to experience significant transformation, creating more opportunities for businesses, investors, and consumers alike.

JP Morgan Chase’s launch of its Nairobi office marks a pivotal moment in the evolution of East Africa’s financial industry. With strong leadership, a clear strategic vision, and an unwavering commitment to emerging markets, the bank is set to play a major role in shaping the future of finance across Africa. As competition heats up, local players and new entrants alike will drive innovation, improve services, and unlock the vast potential of the East African market.