Gautam Adani founder of Adani Group. Photo Credits: Nairobi Daily News via Facebook

Gautam Adani founder of Adani Group. Photo Credits: Nairobi Daily News via Facebook

Adani's Power Play: Controversy And Ambition In Kenya's Mega Projects

Adani Group has subsidiaries which are Adani Enterprises, Ambuja Cement, ACC, NDTV, Adani Ports & SEZ, Adani Power, Adani Green Energy, and Adani Energy Solutions. Gauth company's total assets amount to $19.3 billion, with Adani being among the world's richest people. The company has continued to grow due to its diversification into different industries. They have expanded operations to other parts of the world.

Accusations and Investigations Surrounding Adani Group

However, the company has faced stiff accusations on how it has managed to amass such huge wealth. In 2023, politicians called for a new investigation after the Financial Times reported that the Adani Group appeared to have paid over US$5 billion to middlemen for coal imported far more than market prices between 2021-2023.

It has been accused of involving itself in improper business dealings. It alluded that Adani's close ties to the Prime Minister of India have made it hard to crack a whip on the Adani Group.

International Legal Scrutiny and Financial Freezes

The Swiss authorities have been allegedly conducting a money laundering and securities forgery investigation of the Adani Group since 2021, well before the first Hindenburg report which made the Swiss authorities freeze $310 million of Adani’s Group.

The accusations point to Adani's manipulation of the stock which has been called the largest con in corporate history by using offshore tax haven accounts to drive the company’s stock prices high. The offshore businesses have been used by Adani to carry out its corruption activities.

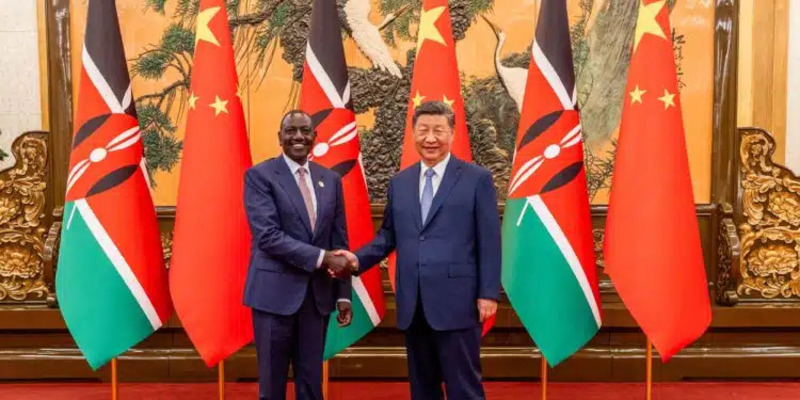

Adani Group’s Expansion into Kenya and Rising Public Outrage

In recent times, Adani has received backlash from Kenyans as it seeks to enter the Kenyan Markets in different industries.

Moreso, Kenyans are aggrieved by the lack of transparency in the dealings between Adani Group and the Kenyan government in the takeover of the Jomo Kenyatta International Airport in a 30-year, 1.84 billion investment deal.

More questions have also been raised by Adani’s interest in building transmission power lines in Kenya in a 94 billion deal tender.

Economic Impact on Kenya and Future Concerns

Prices of electricity rates in Kenya are already high and would lead to more economic pressure on Kenyans due to further increases in electricity rates to repay the amounts to Adani Group.

The group has also been linked to Kenya’s healthcare at an investment plan of Ksh 104 billion through Apeiro Limited, the largest shareholder in the Safaricom consortium.

This leaves Adani exposed further and under public scrutiny as the Kenyan government enters secrecy deals with Adani. It questions whether the Government cares about its citizens or whether such projects have been hijacked by corrupt leaders in Kenya.